The 0.9% Additional Medicare Tax is not affected either. That tax applies to your compensation in excess of $250,000 when you’re married filing jointly ($200,000 when you’re single).

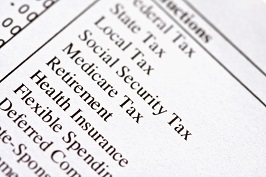

The federal payroll tax rate for employers and employees remains 7.65%, with social security tax withheld and paid at 6.2%, and Medicare tax withheld and paid at 1.45%.

This is general information and should not be acted upon without first determining its application to your specific situation. Please contact your CPA or tax advisor for additional details.

A few reminders for December:

The information presented is of a general nature and should not be acted upon without further details and/or professional guidance. For assistance in identifying and utilizing all the tax deductions to which you are entitled, please contact your CPA or tax preparer.

|

AuthorSuccessfully meeting the challenges inherent to new and smaller businesses provides me with a special type of satisfaction. Archives

February 2022

Categories

All

|

RSS Feed

RSS Feed