For help managing the reporting for and documenting of independent contractors or to select a payroll service for individuals who should be categorized as employees, please schedule a complimentary consultation to review your needs. We'd be happy to help!

This is general information and should not be acted upon without first determining its application to your specific situation. Please contact us, your CPA or tax adviser for additional details.

This is general information and should not be acted upon without first determining its application to your specific situation.

Please contact your CPA or tax advisor for additional details.  Have you noticed the price of gas? So has the IRS – and the reimbursement rate for business mileage has gone down as a result. The new rate for 2017 is 53.5¢ per mile, down from the 2016 rate of 54¢ per mile. The rate for medical and moving mileage also decreased. Effective January 1, the standard rate is 17¢ per mile, down from last year’s 19¢. The charitable mileage rate remains 14¢. This is general information and should not be acted upon without first determining its application to your specific situation.

Please contact your CPA or tax advisor for additional details.

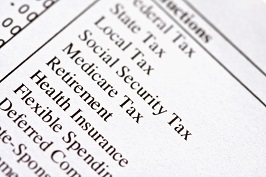

The 0.9% Additional Medicare Tax is not affected either. That tax applies to your compensation in excess of $250,000 when you’re married filing jointly ($200,000 when you’re single).

The federal payroll tax rate for employers and employees remains 7.65%, with social security tax withheld and paid at 6.2%, and Medicare tax withheld and paid at 1.45%.

This is general information and should not be acted upon without first determining its application to your specific situation. Please contact your CPA or tax advisor for additional details.

Are you confused about your choices for paying medical expenses under your employer's benefit plan? Here are differences between two types of commonly offered accounts: a health savings account (HSA) and a health care flexible spending account (FSA). Overview An FSA is generally established under an employer’s benefit plan. You can set aside a portion of your salary on a pretax basis to pay out-of-pocket medical expenses. An HSA is a combination of a high-deductible health plan and a savings account in which you save pretax dollars to pay medical expenses not covered by the insurance. Contributions For 2016, you can contribute up to a maximum of $2,550 to an FSA. Typically, you have to use the funds by the end of the year. Why? Unused amounts are forfeited under what’s commonly called the “use it or lose it” rule. However, your employer can adopt one of two exceptions to the rule. If you are single, the 2016 HSA contribution limit is $3,350 ($6,750 for a family). You can add a catch-up contribution of $1,000 if you are over age 55. You do not have to spend all the money you contribute to your HSA each year. You can leave the funds in the account and let the earnings grow. Earnings FSAs do not earn interest. Your employer holds your money until you request reimbursement for qualified expenses. HSAs are savings accounts, and the money in the account can be invested. Earnings held in the account are not included in your income. Withdrawals Distributions from both accounts are tax- and penalty-free as long as you use the funds for qualified medical expenses. Portability Normally, your FSA stays with your employer when you change jobs. Your HSA belongs to you, and you can take the account funds with you from job to job. That’s true even if your employer makes contributions to your HSA for you. Because you generally can’t contribute to both accounts in the same year, understanding the differences can help you make a decision that best fits your circumstances. This is general information and should not be acted upon without first determining its application to your specific situation. Please contact your CPA or tax advisor for additional details.

Typically, you’ll have beneficiaries for each of your IRAs, your 401(k) or other retirement plans, annuities, and insurance policies. Your designations could be out of date because of life changes. For example, since you made your initial choices, you might have married, had children, or divorced. Some of the beneficiaries you chose could have died, divorced, or married. Changing tax laws also affect beneficiary designations. Choosing the wrong beneficiary, or failing to name a contingent beneficiary, can affect the long-term value of your IRA assets after you die. Make reviewing and updating beneficiary designations part of your year-end financial review. This is general information and should not be acted upon without first determining its application to your specific situation. Please contact your CPA or tax advisor for additional details.

August 1, 2016, is the deadline for filing retirement or employee benefit returns (5500 series) for plans on a calendar year. (The usual due date of July 31, 2016, is a Sunday.)

You’ll also want to note two IRS updates regarding Form 5500. First, the compliance questions are optional. Form 5500 includes new compliance questions for 2015 tax years (returns with a due date of August 1, 2016, for calendar year filers). Because the questions were not approved by the Office of Management and Budget, the instructions for Form 5500 say plan sponsors should skip them when completing the form. Also, some Form 5500-EZ filers will need to file electronically. If you’re required to file at least 250 returns of any type with the IRS, including information returns (for example, Form W-2 and Form 1099), you may need to electronically file Form 5500-EZ for calendar year 2015.

This is general information and should not be acted upon without first determining its application to your specific situation. Please contact your CPA or tax advisor for additional details.

In May, the Department of Labor updated the rules for paying overtime. The changes take effect December 1, 2016, and will affect 4.2 million workers across the country.

Under the new rules, salaried employees who earn less than $913 per week ($47,476 per year) will be eligible for overtime pay. That’s double the annual exempt amount of $455 per week ($23,660 per year) from previous rules. In addition, the total annual pay for an exempt highly compensated employee is $134,004 (up from $100,000 previously). This new threshold will increase every three years beginning in 2020.

To avoid penalties and fines for noncompliance, begin reviewing your payroll now for adjustments needed. Important steps that you should take now include:

For employees who become eligible for overtime under these new rules, employers have a choice of three actions they can take:

In some cases, a business owner may find it cheaper to hire an additional part-time worker to handle work that now requires overtime hours. You can find more about the new overtime law here.

This is general information and should not be acted upon without first determining its application to your specific situation. Please contact your CPA or tax advisor for additional details.

It's that time of the year again! Beginning this month, you can sign up for a new 2016 health insurance policy on the health insurance Marketplace. You can also change or renew the policy you purchased during the last enrollment period. Even if your current policy has an automatic renewal feature, you’ll want to verify that you are still eligible for the federal premium tax credit.

What if you didn’t sign up last winter and didn’t have health insurance coverage in 2015? You may owe a penalty on your 2015 federal income tax return. The penalty for 2015 is the greater of $325 per adult and $162.50 per child under 18 (up to a maximum per-family penalty of $975) or 2% of your modified adjusted gross income (with a maximum of the national average premium for a Bronze plan). For additional information from www.Healthcare.gov, check out this article: 5 Tips About the Health Insurance Marketplace.

Image courtesy of cooldesign at FreeDigitalPhotos.net

I read an article this week about a company called AnyPerk, which provides employee perks to companies that want to enhance their employees' experience when there isn't a large benefits budget. The reference is below:

Entrepreneur magazine, June 2015 - Cover Series: The Brilliant 100 Article: That Something Extra If you know of any other service providers that also support small business employee perks, please feel free to comment with the website. |

AuthorSuccessfully meeting the challenges inherent to new and smaller businesses provides me with a special type of satisfaction. Archives

February 2022

Categories

All

|

RSS Feed

RSS Feed